Rumya for Financial Intermediaries

Makes it easier to manage your day-to-day business

At a time when compliance needs are increasingly robust and the constraints and opportunities linked to digitalization are booming, it is essential to be able to rely on ergonomic, secure and efficient digital tools.

Designed in partnership with experts from each profession, Rumya for Financial Intermediaries is an extended client-relationship and portfolio management software. It allows you to document your activity in accordance with the new Supervision and Control Act, MLA, and international taxation policies.

From CHF 100.- per user per month! Test your future software now.

Contact usLSFin/LEFin

The regulations for financial intermediaries, which came into force on 1 January 2020, are changing:

- The LSFin defines the rules of conduct that financial services providers must respect with regard to their clients, particularly in terms of information obligations, client classification and documentation of the financial instruments offered.

Click here to find out more - LEFin standardises the licensing regulations for financial institutions, extends prudential supervision for certain categories of financial intermediaries and strengthens organisational requirements.

Click here to find out more

Thanks to a specifically configured tool, each of the following professions benefit from an adapted solution:

Independent asset managers

Family Office

Trust managers

Trustees

Fund managers

Compliance management

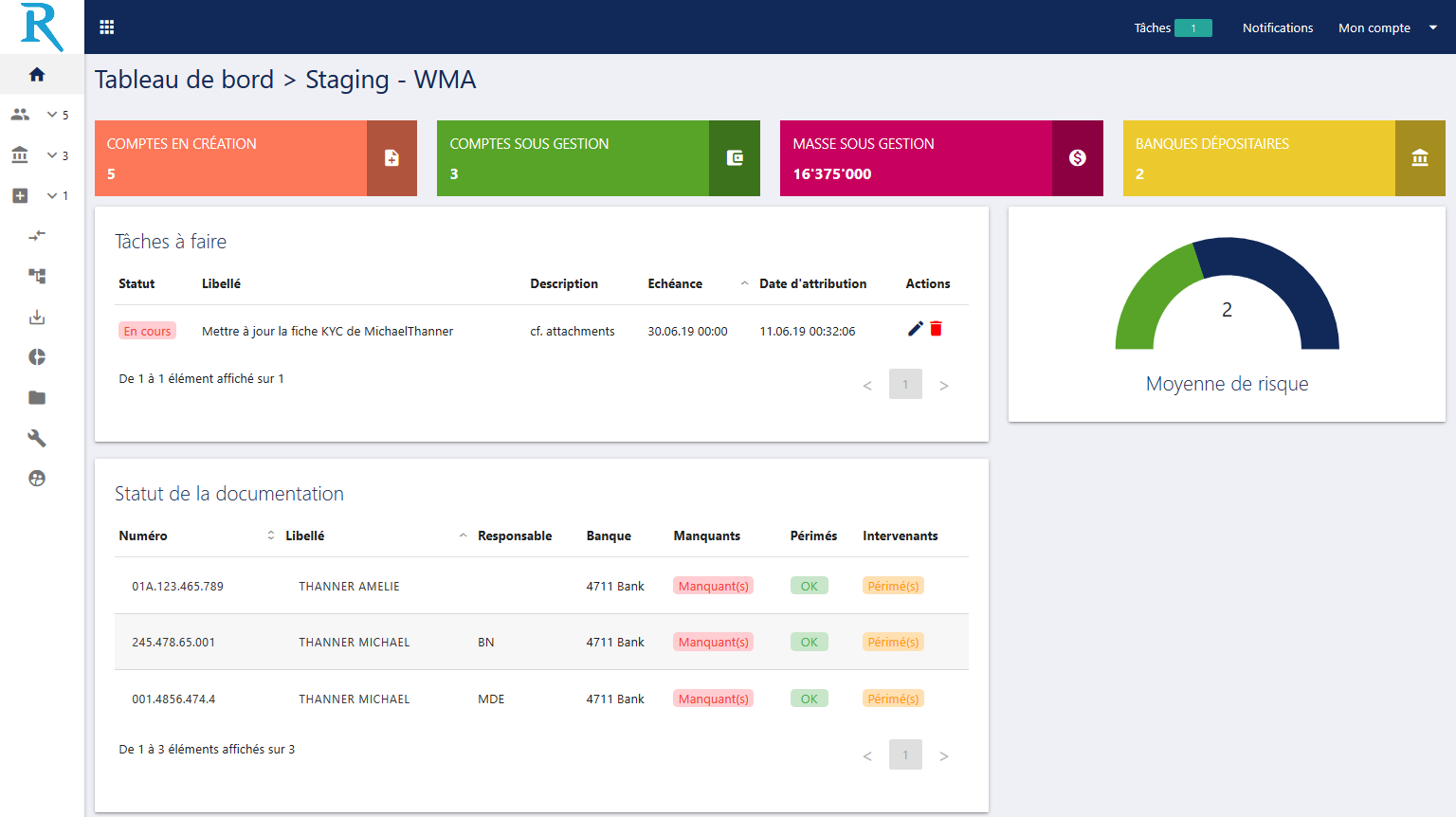

Dashboard

Indicators and alerts providing a global view of the company's activity

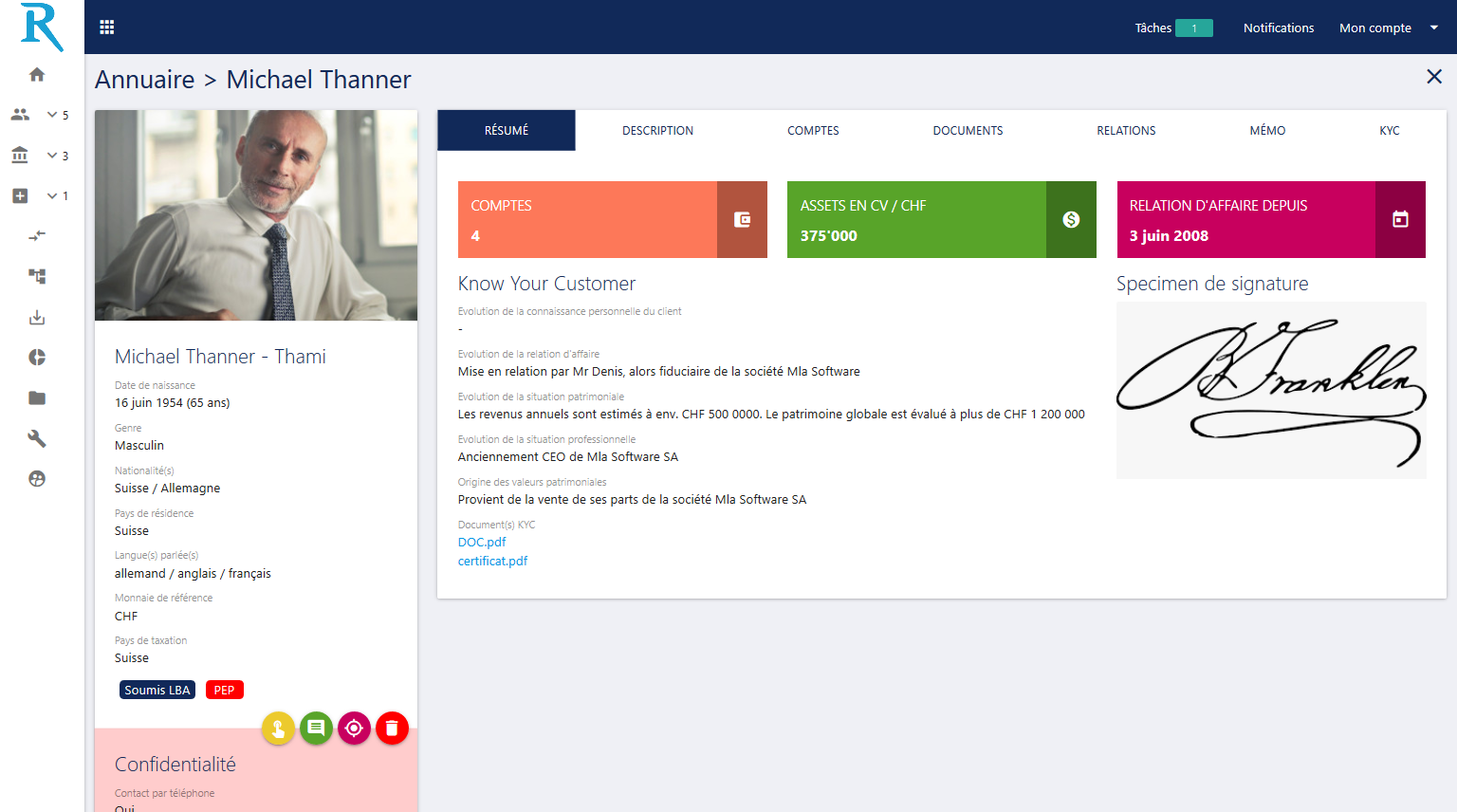

Customer relationship management

All customer data, including KYC/memos/relationships are easily accessible and intuitively organised

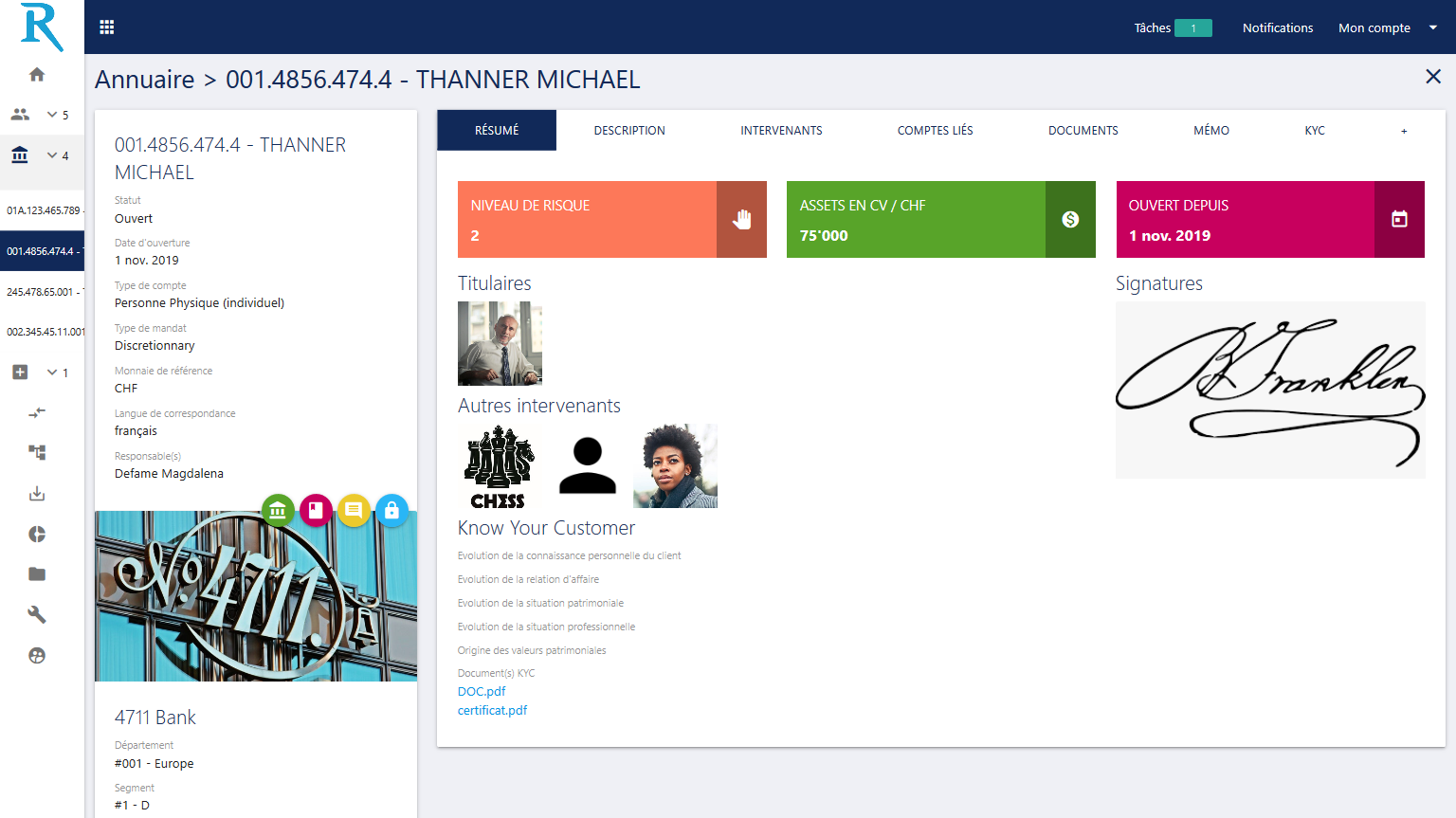

Portfolio management

Portfolio organisation: from onboarding and stakeholder management to daily monitoring of transactions, assets and bank cards

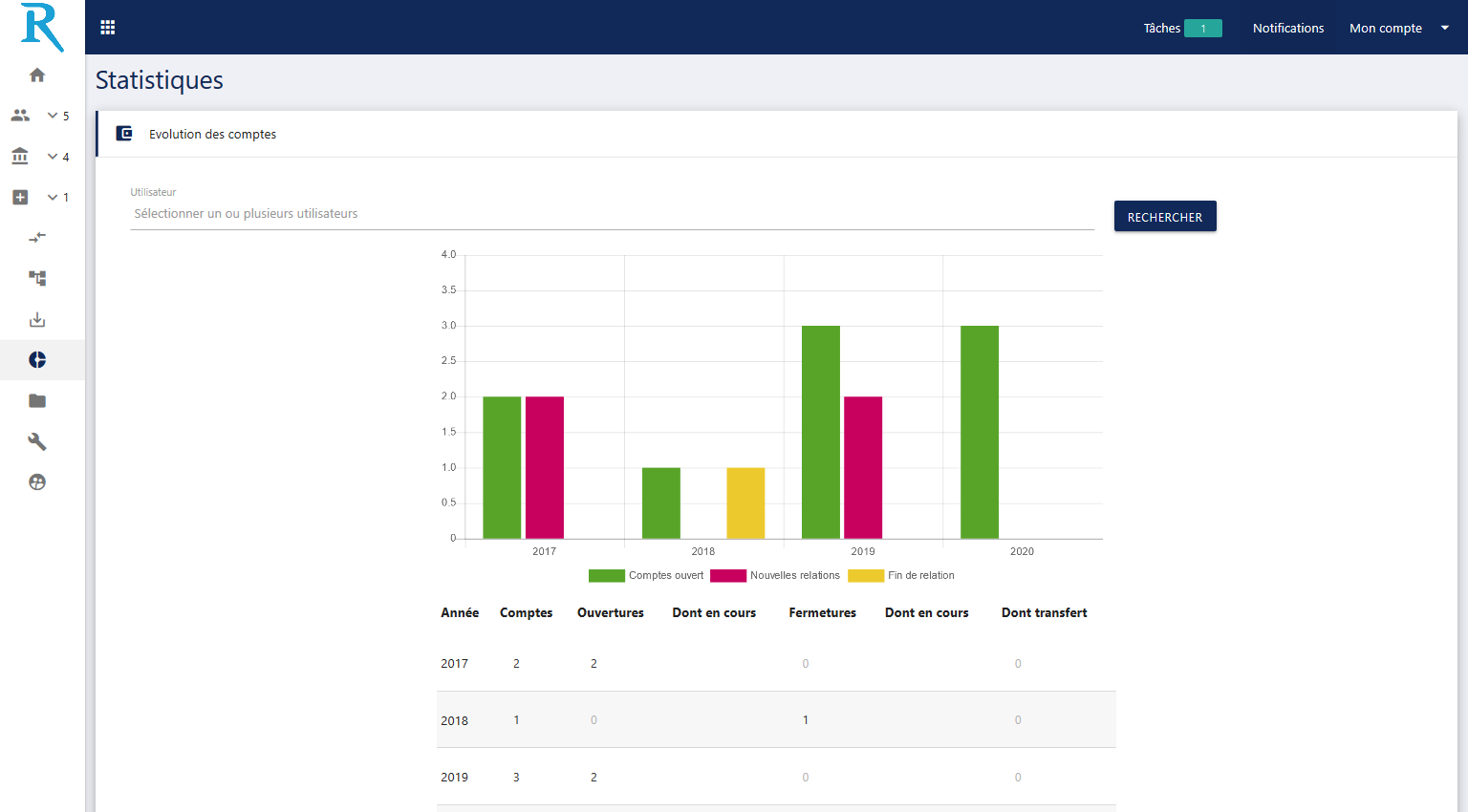

Statistics

Visual summary of company data with dynamic charts and tables

Audit reports

Automated generation and preparation of lists and reports required during audits

Risk assessment

Evaluation of the MLA risk of a portfolio based on configurable criteria

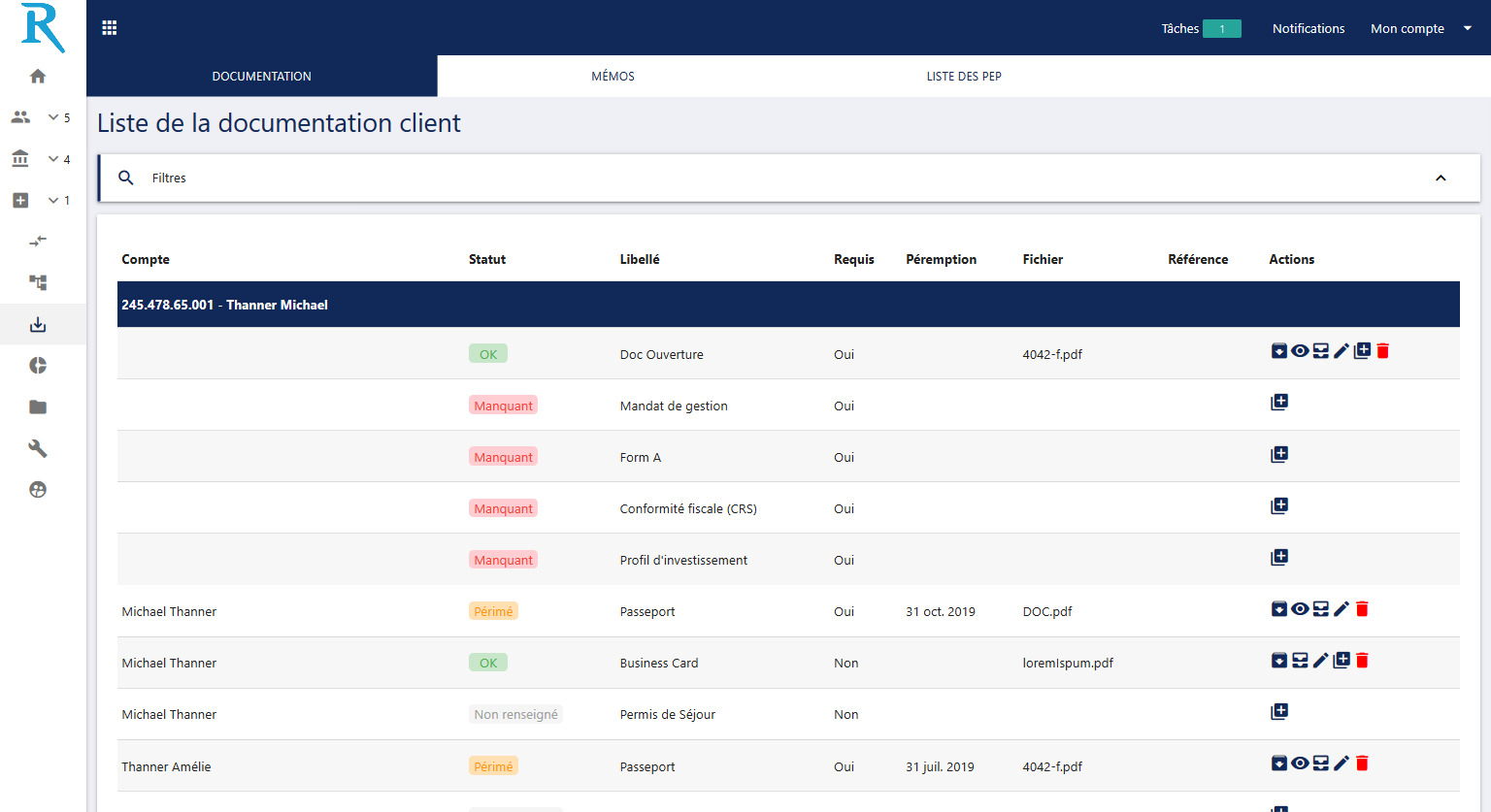

Document management

Client and portfolio documentation management including alerts, mailings and version history

Mobile access

Tool accessible on smartphone, tablet and computer, anytime, anywhere

Tailor-made integration

Rumya connects to the company's ecosystem using connectors and APIs

Portfolio management

Performance and benchmarks

Performance monitoring, comparisons based on benchmarks defined by investment profile and base currency, deviation documentation.

Bank synchronisation

Daily collection of positions and transactions pertaining to accounts under management at custody banks.

Asset allocation

Configuration of upper limits for each type of asset in portfolios and proactive alerts in the event of irregularities.

Consolidation of positions

Combining bank positions per account, customer, bank, or asset class for search, analysis and reporting purposes.

Cash-flow analysis

Collecting cash flows in portfolios and entering supporting documents according to configurable alert criteria.

Placing orders

Entering, automated sending and archiving of purchase and selling orders, as well as relevant documentation, with custody banks.

Noteworthy information

Data encryption

Transversal securing of exchanges and data

Fully customisable

Customisation of interfaces and functionalities according to the particularities of a company

GDPR/FADP Compliance - Privacy by Design

Benefit from Rumya's expertise in terms of data protection and confidentiality right from the start

White mark

Possibility of customising the software to your own colours

Multilingual

Management interfaces available in several languages

Hosting in Switzerland

Hosting and replication in secure data centres in Switzerland or hosting to choice at request.

« Our entire team has been using Rumya on a daily basis for over a year. The software is perfectly adapted to our needs and is pleasant to use. Moreover, it has really simplified the preparation of our audits. And the Rumya team is very responsive! »